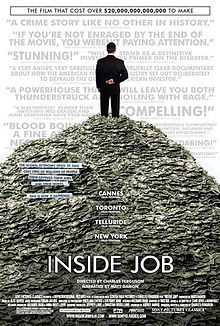

Last night we watched the film Inside Job, directed by Charles Ferguson (co-produced by Jeffrey Lurie, owner of the Philadelphia Eagles), telling the story of how financial deregulation contributed to the global recession of the late 2000’s. In 2010 it won the Oscar for best documentary.

Last night we watched the film Inside Job, directed by Charles Ferguson (co-produced by Jeffrey Lurie, owner of the Philadelphia Eagles), telling the story of how financial deregulation contributed to the global recession of the late 2000’s. In 2010 it won the Oscar for best documentary.

Best line from the poster, “The film that cost over $20,000,000,000,000 to make.” (That’s trillions, in case you don’t count zeroes.)

Even if you don’t have a degree in economics (full disclosure, I do), you should be fascinated by this film.

All film-makers have their biases, but Ferguson makes both Republicans and Democrats look bad. Reagan, Clinton and Bush (W) encouraged or allowed the deregulation, and Obama re-appointed the guys who contributed signficantly to the meltdown (e.g., Bernanke, Summers).

A few of the interviewees stutter and embarrass themselves (in particular, Fed Board governor Frederic Mishkin, Columbia Business School’s R. Glenn Hubbard), which is sad to watch (and kind of fun, too, in a sadistic sort of way).

George Soros, philanthropist, provided an insightful analogy of an oil tanker. As tankers got bigger, boat designers realized they needed multiple compartments to prevent the oil from sloshing around and making the tanker capsize. In the same way, financial markets needs barriers to divide up the various realms of finance. If these barriers were still in place it could have prevented corporations like AIG from becoming to big to collapse. The Savings and Loan crisis of the late 1980’s was caused by deregulation and resulted in tax-payer losses of $124 billion.

It’s naive to think that regulators are unnecessary in the realm of finance (all people, even financial wizards are after all, evil). Just as we need police on our streets, guards on our borders and playground monitors at recess, the world of finance needs regulators to hold people accountable.

The people primarily responsible for the crisis came out like bandits, with 9-figure+ payouts and bonuses. The people most affected by the crisis are, as is always the case, the poor.

If you or anyone you care about was negatively affected by the global financial meltdown (that’s pretty much everyone), you should see this film.